Sunlife Life Insurance Quote Review United Kingdom

Sunlife offers a variety of life insurance options to help you protect your loved ones and secure your financial future. Whether you’re looking for term life insurance or permanent life insurance, Sunlife has solutions to meet your needs.

Types of Life Insurance

Sunlife provides several types of life insurance, including term life insurance and permanent life insurance. Each type offers different benefits and coverage options to suit your individual requirements.

Term Life Insurance

Term life insurance is a cost-effective option that provides coverage for a specific period, typically ranging from 5 to 40 years. If you pass away during the term, your beneficiaries will receive a tax-free lump sum payment. Sunlife offers flexible term lengths and affordable premiums to ensure your loved ones are financially protected.

What is Sunlife Life Insurance?

Sunlife Life Insurance Smart Pro is a financial safety net designed to protect your loved ones in the event of your passing. With a variety of plans tailored to different needs, Sunlife offers peace of mind and financial security for policyholders and their families.

Permanent Life Insurance

Key Benefits of Sunlife Life Insurance

1.✅ Financial Protection for Loved Ones

Life insurance ensures that your family members are financially secure if the unexpected happens. Sunlife Life Insurance pays out a lump sum amount to the beneficiaries, helping them maintain their lifestyle or cover essential expenses.

2.✅ Flexibility and Customization

Sunlife provides customizable policies, allowing you to tailor your coverage according to your needs and budget. This flexibility ensures you get the exact type of coverage that fits your life stage and financial goals.

3.✅ No Medical Exam Required

Unlike traditional life insurance, many of Sunlife’s policies don’t require a medical examination, making it easier and quicker to get covered, especially for those with pre-existing conditions.

4.✅ Guaranteed Acceptance

Sunlife offers guaranteed acceptance plans, especially for those aged 50 and over. This means that anyone within this age range can be accepted for coverage, regardless of their health status.

5.✅ Fixed Monthly Premiums

Types of Sunlife Life Insurance Policies

1.🌐 Over 50s Life Insurance

This policy is specifically designed for individuals aged 50 and above. It guarantees acceptance with no medical exam required. The policy typically covers funeral costs, outstanding debts, or gifts for loved ones.

2.🌐 Term Life Insurance

This type of insurance provides coverage for a specific period. If the policyholder passes away within the term, a lump sum is paid to beneficiaries. Term life insurance is a cost-effective option for temporary financial needs.

3.🌐 Whole of Life Insurance

Whole of life insurance guarantees a payout no matter when you pass away, as long as the premiums are kept up to date. It can help pay for funeral expenses, debts, and other financial responsibilities.

4.🌐 Funeral Cover

Sunlife’s funeral cover policy is specifically designed to cover funeral expenses, ensuring that your family doesn’t face financial stress during an already difficult time.

One of the most attractive features of Sunlife Life Insurance is its fixed premium structure. Once you lock in a premium rate, it stays the same for the duration of the policy, offering predictability and financial planning advantages.

Permanent life insurance offers lifelong coverage and includes a savings component that can grow over time. This type of insurance is ideal for those who want to leave a legacy and provide financial security for their beneficiaries. Sunlife’s permanent life insurance options include whole life insurance and universal life insurance.

Benefits of Sunlife Life Insurance

Sunlife’s life insurance policies come with several benefits, including guaranteed death benefits, fixed premiums, and the option to convert term policies to permanent policies. Additionally, Sunlife offers no medical exam options for certain policies, making it easier to apply for coverage.

How to Get a Quote

Getting a Sunlife life insurance quote is simple and convenient. Visit the Sunlife website, answer a few questions about your health and coverage needs, and receive a personalized quote. You can compare different policy options and choose the one that best fits your budget and requirements.

Conclusion

Sunlife life insurance provides peace of mind and financial security for you and your loved ones. With a range of coverage options and flexible terms, Sunlife is committed to helping you find the right insurance solution.

71-75 Shelton Street, Covent Garden, London, WC2H 9JQ

Sunlife Life Insurance Prices

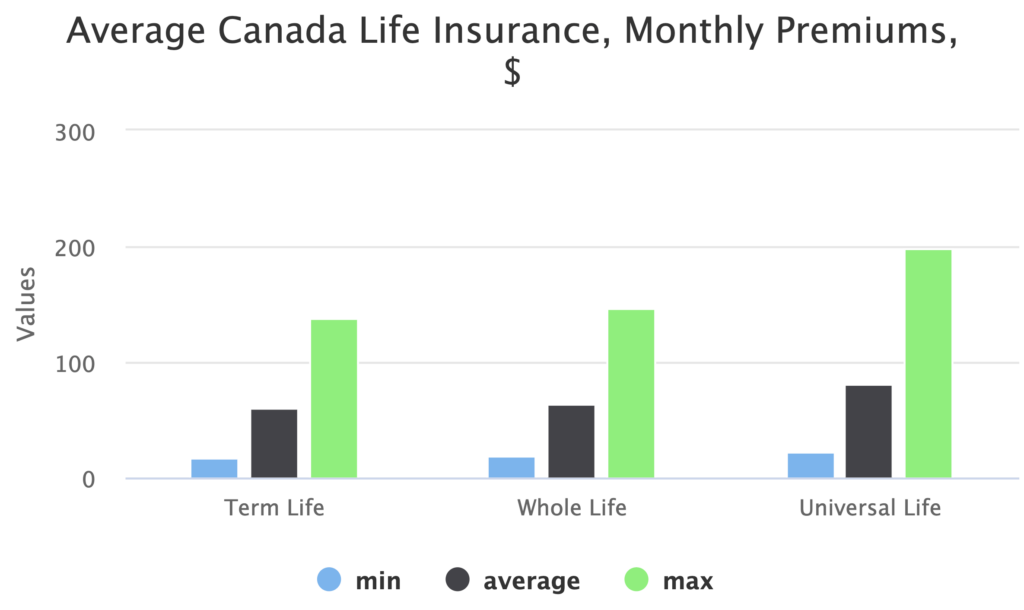

Sunlife life insurance prices vary depending on several factors, including your age, gender, smoking status, and the amount of coverage you need. Here are some general price ranges:

- Term Life Insurance: For a healthy individual in their 30s, term life insurance premiums can start as low as $20 per month for $100,000 of coverage. The cost increases with age and coverage amount.

- Permanent Life Insurance: Permanent life insurance, such as whole life insurance, typically has higher premiums due to lifelong coverage and the savings component. Premiums can start around $150 per month for $100,000 of coverage.

Factors Affecting Prices

- Age: Younger applicants generally pay lower premiums.

- Gender: Women often pay lower premiums than men due to longer life expectancy.

- Smoking Status: Smokers usually pay higher premiums than non-smokers.

- Coverage Amount: Higher coverage amounts result in higher premiums.

MONTHLY PREMIUM RATES 2024

Canadian Dental Hygienists Association Insurance Program